In a highly competitive market like insurance, the generation of sales opportunities is crucial to the success of any agent or company, which every day faces challenges such as a lack of consumer trust or fierce price competition. Given the wide variety of options available to potential clients on the market, it is essential to stand out from the crowd and offer solutions adapted to their needs. But sometimes, generating leads can be just as challenging as converting them.

So how can you effectively increase sales in the insurance sector?

In this article, we’ll look at some strategies for effectively generating insurance leads and discuss what marketers should do to capitalize on their potential.

Continue reading!

How to Boost Insurance Sales: Lead Generation Strategies

Even for the most experienced insurance agent, it’s important to understand that there is no magic solution to driving sales. However, providing a flexible and adapted sales process, both to the changing demands of buyers and to the always dynamic conditions of the market, will be crucial to generate potential customers interested in the offers that your company has available. This will ultimately result in an increase in sales.

Below, we provide you with some lead generation strategies that can be key to identifying prospects and improving your conversion rates:

• Website Optimization and SEO:

Make sure your website is well designed, easy to navigate, and search engine optimized (SEO). By using relevant keywords in your content, you can improve your visibility in search results and attract quality organic traffic.

• Value Content:

Create insurance-related content that is relevant and useful to users and share it through your website, blog and social networks. Articles, infographics, explanatory videos or practical guides are some examples of content that will help you establish your credibility as an insurance expert and gain the trust of your potential clients.

• Effective Use of Contact Forms:

Implement clear and easy-to-use contact forms on your website and other digital platforms and ensure you respond quickly to queries received through them. Make sure that these forms request relevant information, but at the same time, that they are not too long or complicated, as this could discourage visitors from completing them.

• Segmented Online Advertising:

Use online advertising platforms such as Google Ads, Facebook Ads or LinkedIn Ads, to reach specific audiences based on their demographic characteristics, interests and behaviors. By segmenting your ads, you will be able to reach a greater number of people who are probably interested in your insurance products.

• Referral Programs:

Implement a referral program that encourages your current customers to recommend your products and services to their friends, family and acquaintances. By offering incentives, such as premium discounts or other types of rewards for each successful referral, you will be able to increase your customer base.

• Strategic Alliances:

Collaborate with other professionals and companies that do not compete directly with you but have similar audiences. For example, you can establish collaboration agreements with companies belonging to the real estate, healthcare or financial sectors.

• Personalized Email Marketing:

Use email marketing to maintain contact with your current and potential clients. By sending newsletters, product updates or personalized offers, you can maintain interest and encourage conversion.

• Traditional Advertising:

Although the focus on online advertising is crucial in the digital age, do not underestimate the power of traditional advertising. Depending on your target market and your resources, consider traditional advertising strategies such as ads in local newspapers, trade magazines, billboards, and radio spots. Make sure your messages are clear, impactful, and targeted to your specific audience. Combining online and traditional advertising strategies can increase your reach and improve the overall effectiveness of your lead generation campaign.

As you see, effective insurance lead generation requires a strategic approach, combining digital and traditional marketing tactics. By implementing these strategies consistently, you can maximize your potential to attract high-quality leads and convert them into satisfied customers.

If you are now wondering if there is a tool that can help you implement and get the most out of your insurance lead generation strategy, continue with us.

What we are going to tell you is sure to interest you!

Maximize lead generation with Webphone

Once you have identified the best strategies, you can start your campaign to attract prospects interested in insurance, and at Webphone we can help your team attract and collect information from potential clients.

Webphone is a powerful conversational artificial intelligence and call tracking which can be essential in the insurance sector. Our suite of tools is designed to boost generation efficiency and lead management, thus contributing to increasing the conversion rate.

Below, we show you some of the Webphone functionalities that can help you with the generation of potential clients in the insurance field:

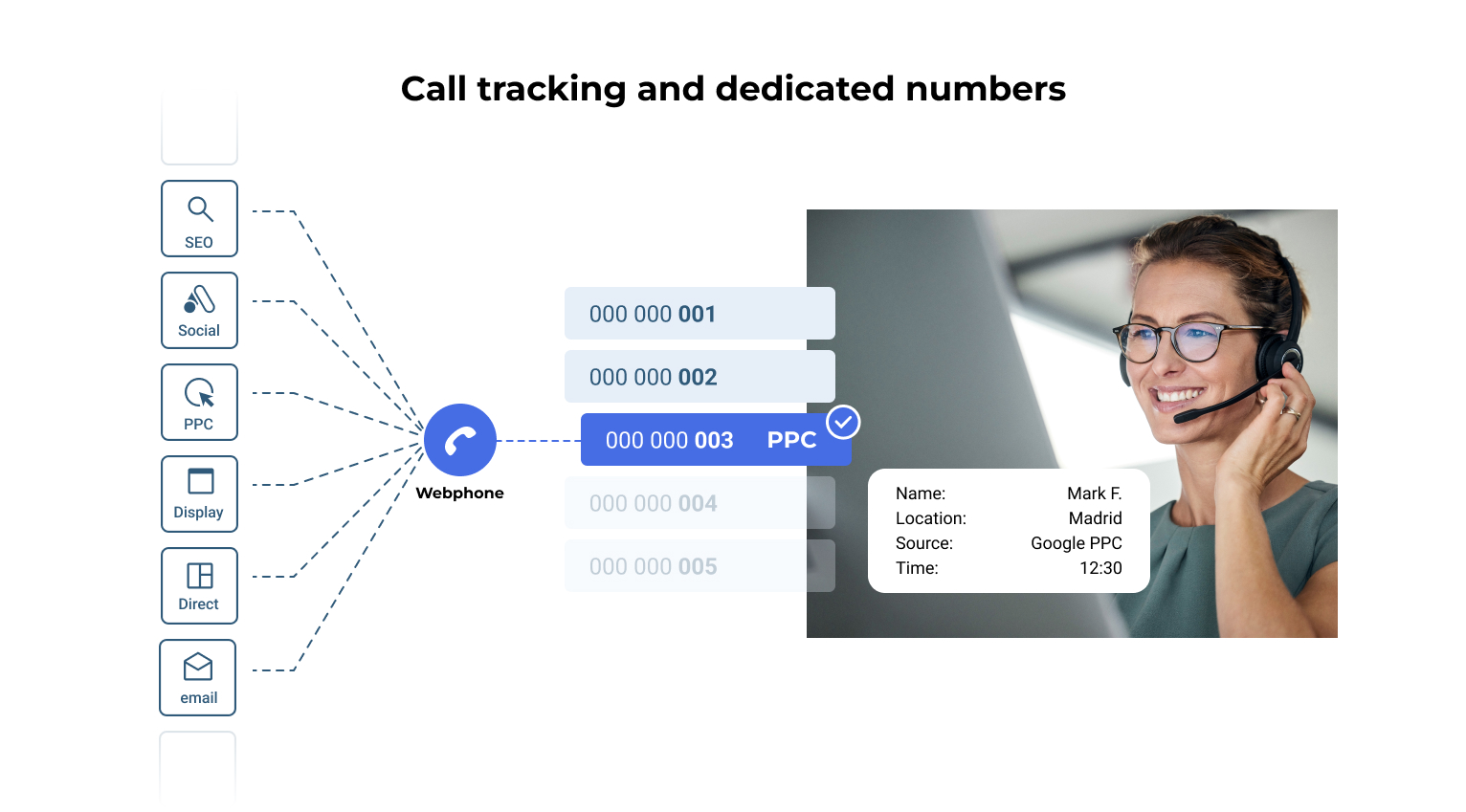

CALL TRACKING and DEDICATED NUMBERS

Dedicated numbers can be a very useful tool to optimize your lead generation campaigns in several ways:

#1. Segmentation and tracking: By assigning dedicated numbers to your different campaigns or marketing channels, you will be able to more accurately track the effectiveness of each one. This will allow you to identify which strategies are generating the most leads and adjust your efforts accordingly.

#2. Personalization and A/B Testing: Using dedicated numbers, you’ll be able to conduct A/B testing to determine which approaches or messages resonate best with your audience.

#3. Data Analysis: By associating each dedicated number with a specific campaign, you will be able to collect detailed data on the performance of each one. This will allow you to perform in-depth analysis to identify trends, patterns, and areas for improvement in your insurance lead generation strategies.

#4. Optimization of resources: By knowing which campaigns are generating the most quality leads in the insurance field, you will be able to allocate resources and budget more efficiently, thus maximizing your return on investment and your success in acquiring potential clients .

CALL RECORDING AND TRANSCRIPTION

Using Webphone’s conversational artificial intelligence technology, you can record and transcribe phone calls in real time. By accurately transcribing calls you will achieve:

#1. Record key data: By recording your calls with potential clients, you can capture valuable information about their needs, concerns and preferences regarding insurance.

#2. Analyze conversations: Call transcription will allow you to analyze the information collected in detail, identifying keywords, behavioral patterns and recurring themes among potential customers. This information will help you better understand your audience’s needs and adjust your strategies accordingly.

#3. Identify sales opportunities: By reviewing call transcripts, you can identify potential sales opportunities that you may have missed during the conversation, so you can maximize each interaction with potential customers and increase your conversion rates.

#4. Improve your team’s training: You can also use call recordings and transcripts to improve the training of your sales team. By reviewing past interactions, you will be able to identify areas for improvement and provide specific feedback to your company representatives to optimize their performance.

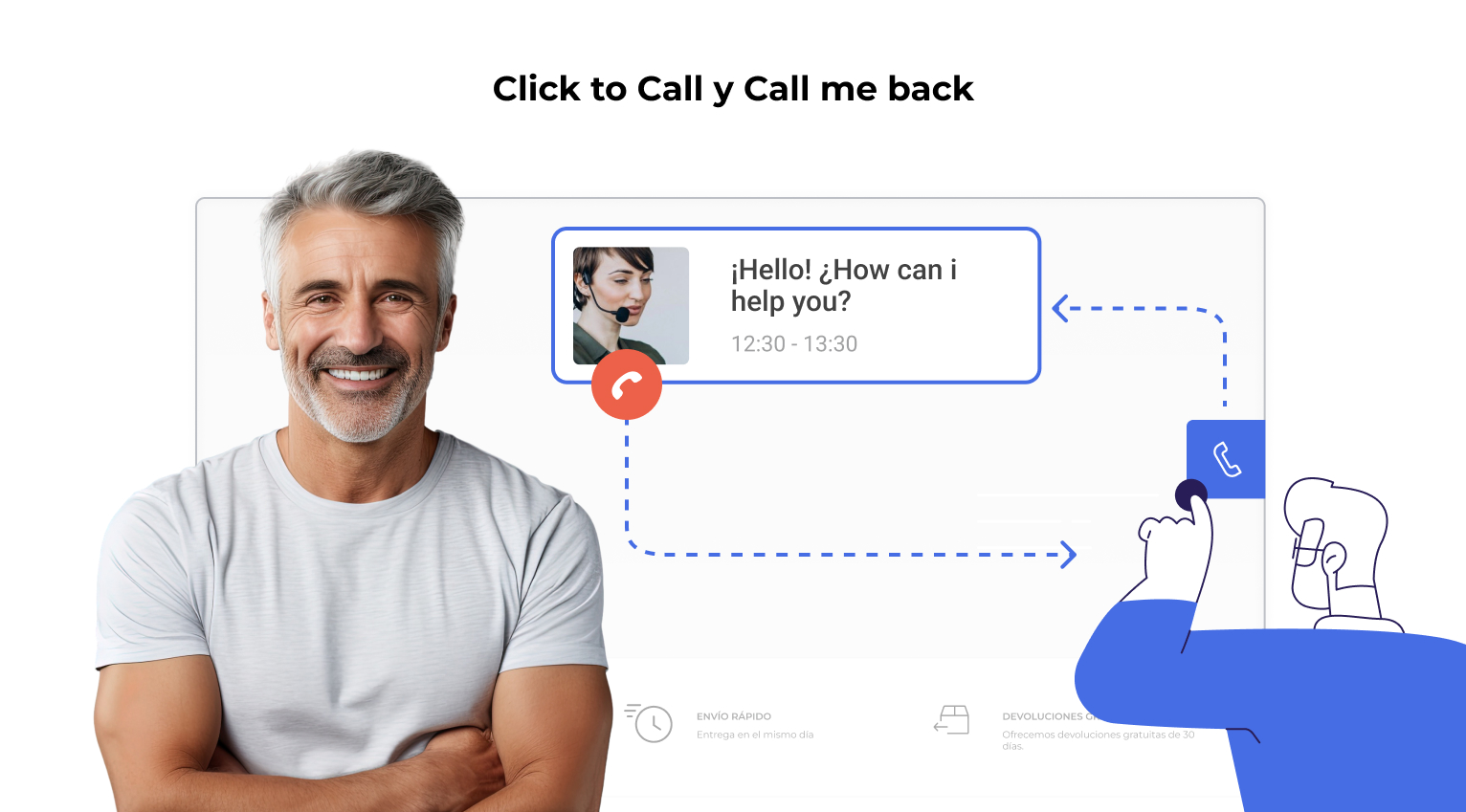

CLICK TO CALL AND CALL ME BACK

These are powerful tools that can significantly help you generate leads in the insurance sector. I explain how:

#1. Facilitates instant communication: Click to Call allows users to click a button on your website to initiate a direct phone call with your insurance company. This removes the barrier of having to search for and dial a phone number, which can increase the likelihood of site visitors converting into leads.

#2. Leverage Customer Interest: Call Me Back allows users to request a call back from a representative of your insurance company instead of having to wait in line. This is especially useful for clients interested in your services who cannot speak at the moment.

#3. Improved user experience: By offering an easy and convenient way to communicate with your company, both tools improve the user experience, thereby increasing customer satisfaction and retention.

#4. Capture leads outside of working hours: With the “Call Me Back” option, you can capture leads even outside of working hours. Potential customers can leave their contact information and calling preferences, allowing your sales agents to contact them at a mutually convenient time.

Conclusion

In any sector, and that also includes the insurance sector, lead generation is crucial to achieving business success, and although using the different tactics that we have seen at the beginning of this article can help you speed up the process of attracting potential clients, you don’t have to face this challenge alone.

Using lead generation software will significantly boost your results, and in this sense, Webphone offers you comprehensive solutions with functionalities such as dedicated numbers, call recording and transcription, or tools such as the Click to Call or Call me Back , which will help you improve the effectiveness of lead generation and will provide you with valuable information about the needs and interests of your potential clients.

As you can see, Webphone’s conversational artificial intelligence solutions are an essential complement to any insurance sales strategy. Integrating our technology tools into your business approach will help you stay competitive and achieve success in the demanding insurance market.

What are you waiting for? Call us!, We will be happy to provide you with everything you need to start maximizing your sales opportunities as soon as possible.

Success is just a click away!